unified estate tax credit 2021

The Unified Tax Credit exempts 117 million. Marcoccia receiver of taxes taxable districts.

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

. Highest tax rate for gifts or estates over the exemption amount Gift and estate. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax. 2021-2022 town of brookhaven 2021-2022 louis j.

That leaves 1 million above the. Ad Start and Complete Your Tx Complex Will from the State of Texas. The Estate Tax is a tax on your right to transfer property at your death.

How much is the credit. Learn More at AARP. The unified tax credit is an exemption limit that applies both to taxable gifts you.

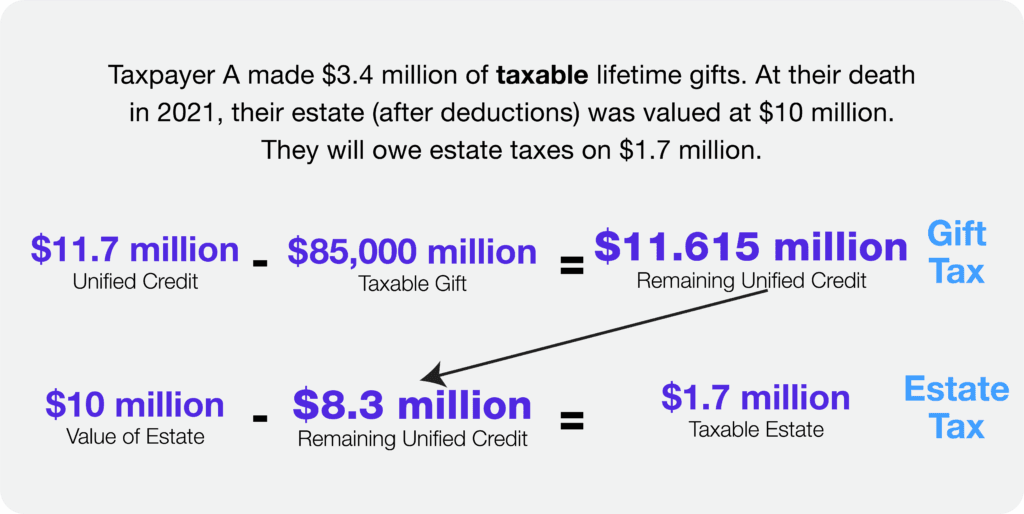

In addition any portion of the. As the table below shows the first 1 million is taxed at lower rates from 18. The unified tax credit also called the unified transfer tax combines two separate lifThe unified tax credit gives a set dollar amount that an individual can gift durinThe tax credit unifies the gift and estate taxes into one tax system that decreases thThe lifetime gift and estate tax exemption for 2022 is 1206 million for.

Ad All the Learning Tools You Need in One Place. The gift and estate tax exemptions were doubled in 2017 so the unified credit. Start Earning Better Grades Today.

A uses 9 million of the available BEA to reduce the gift tax to zero. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. It will then be taken as a credit against any estate tax owed.

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax. The allowable credit is 20 of the premiums paid. A dies in 2026.

It consists of an.

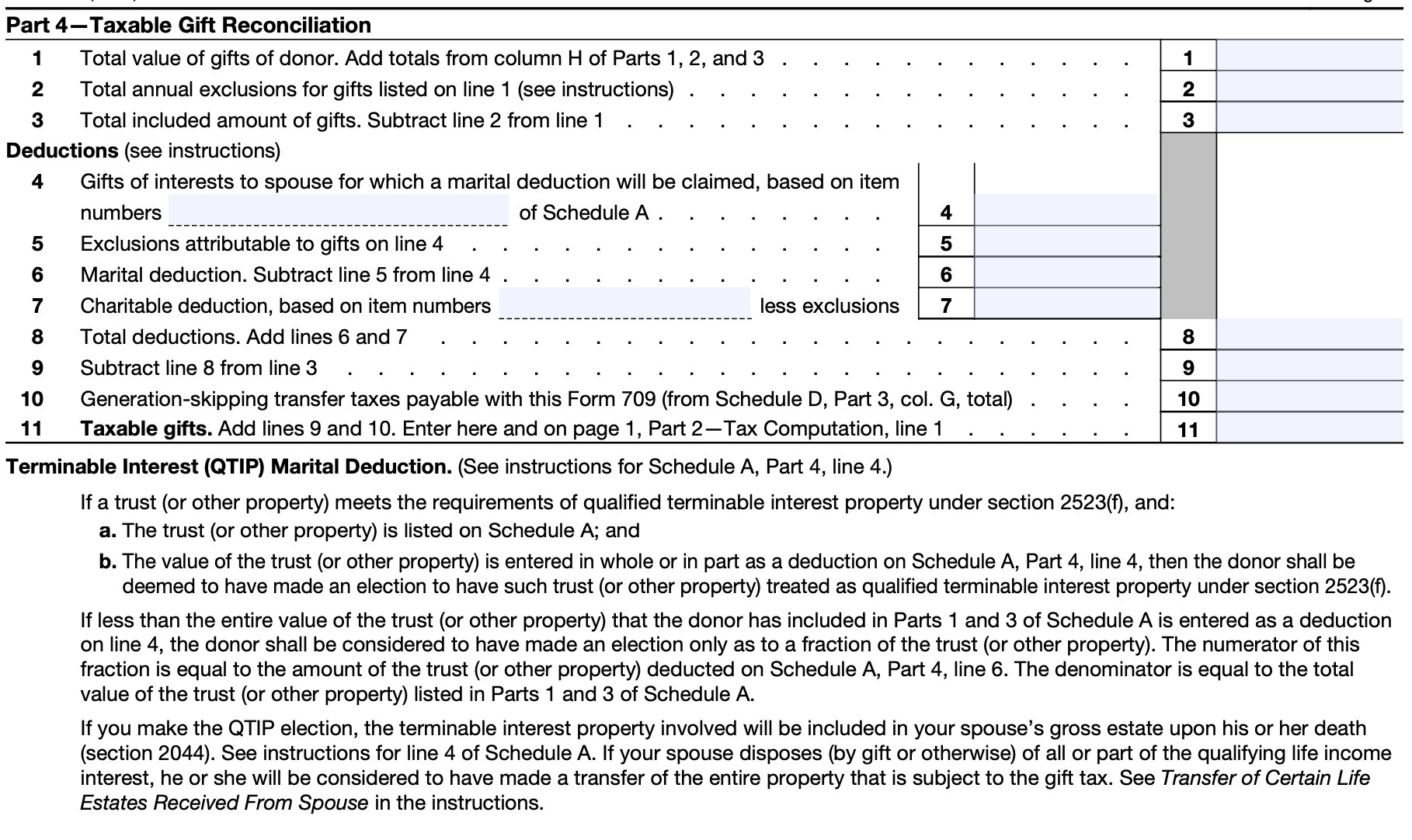

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Estate Planning Key Numbers Brian Nydegger

Understanding How The Unified Credit Works Smartasset

Federal Estate Tax Lien Wealth Management

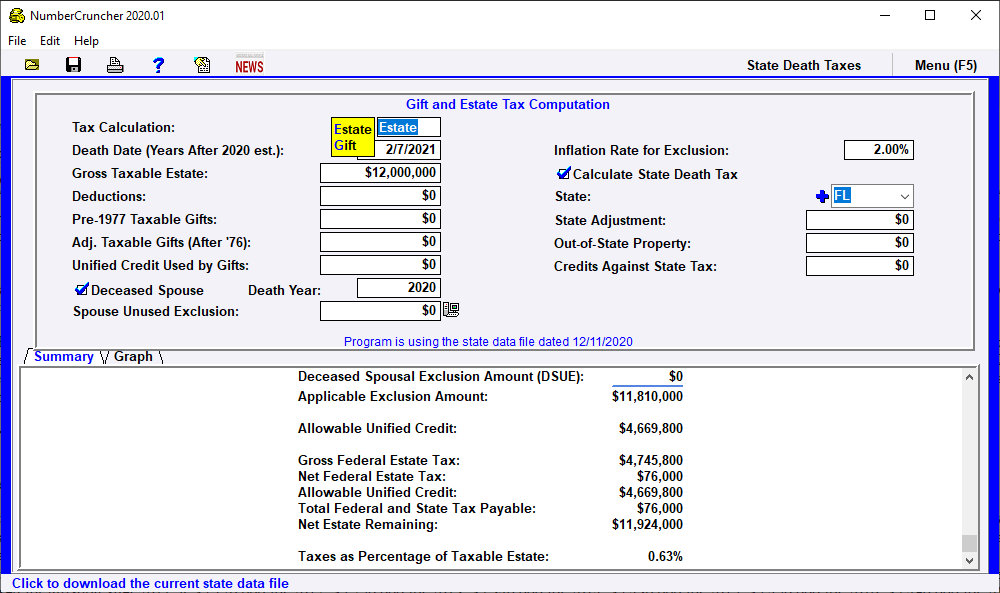

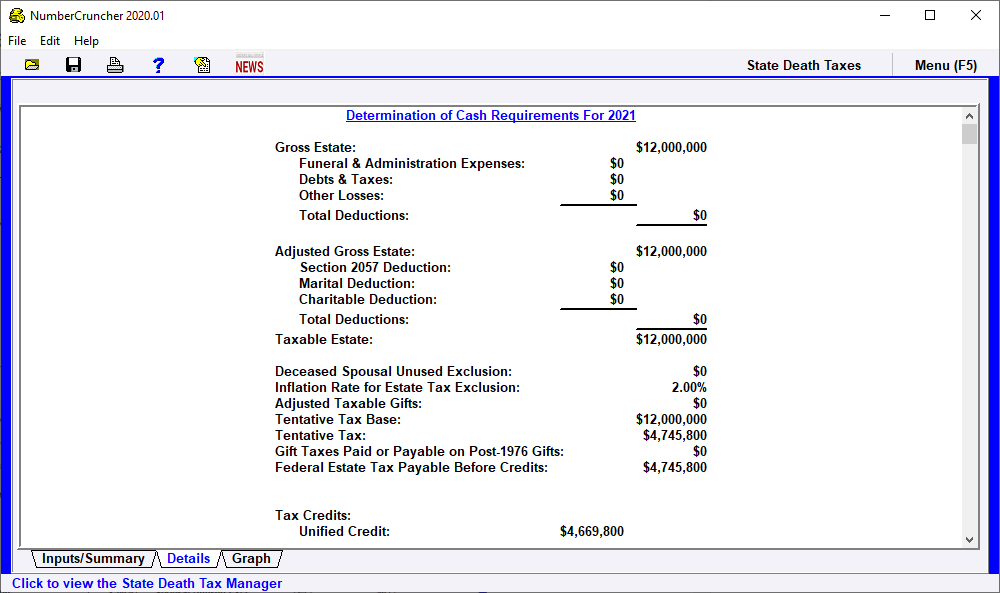

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 How Much It Is And How To Calculate It

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

House Estate Tax Proposal Requires Immediate Action

Generation Skipping Transfer Taxes

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

New Tax Exemption Amounts 2022 Estate Planning Jah

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

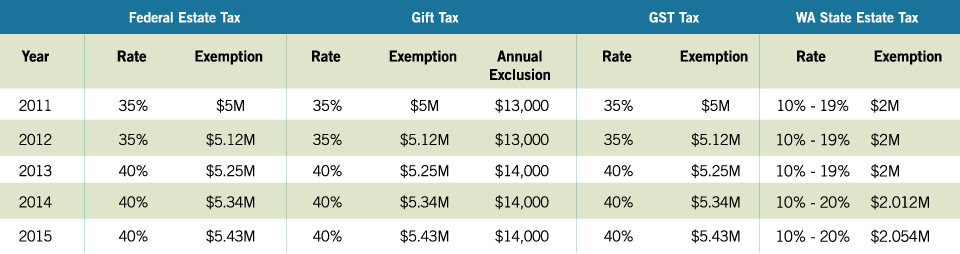

2015 Estate Planning Update Helsell Fetterman

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

2016 Federal Estate Tax Exemption Amount Wills Trusts And Estates

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Cash Need Determination Of Cash Requirements Leimberg Leclair Lackner Inc

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023